Are you struggling with completing your books every day – can’t get caught up or tax extended because you don’t have a good set of books maintained through the year? If this is you, I want to work with you – yes, genuinely HELP you! 10% of the Small Businesses I talk to are behind on their tax payments, probably close to 90% don’t do monthly bookkeeping. Small business start-ups and even long-term service providers are stuck at this time of year—the books are out of wack!

Listen, you don’t need to fret any longer. Let’s get your books up to date: Connect with me here: Talk to Me. Together we can get your Quickbooks Online package up and running quickly – even before year-end. I have room for two!

Not to scare you more, but here’s what Canada.ca/taxes recently posted:

As of 2018, Guide T4003, Fishing and Farming Income, is no longer published. Instead, use Guide T4002, Self-employed Business, Professional, Commission, Farming, and Fishing Income 2018. The 2018 version of Guide T4002 includes tax information for all types of self-employment.

Because my client focus is small business, I want you to refamiliarize yourself with the necessity of business records.

They write: “You are required by law to keep records of all your transactions to be able to support your income and expense claims. A record is defined to include an account, an agreement, a book, a chart or table, a diagram, a form, an image, an invoice, a letter, a map, a memorandum, a plan, a return, a statement, a telegram, a voucher, and any other proof containing information, whether in writing or in any other form. Keep a record of your daily income and expenses.”

Benefits of keeping complete and organized records:

You can benefit from keeping complete and organized records. For example:

- When you earn income from many places, good records help you identify the source of income. If you keep proper records, you may be able to prove that some income is not from your business, or that it is not taxable.

- Keeping good records will remind you of expenses you can deduct when it is time to do your income tax return.

- Good records will keep you better informed about the past and present financial position of your business.

- Good records can help you budget, spot trends in your business, and get loans from banks and other lenders.

- Good records can prevent problems you may run into if we audit your income tax returns.

Consequences of not keeping adequate records:

If you do not keep the necessary information and you do not have any other proof, we may have to determine your income using other methods. We may also disallow expenses you deducted if you are unable to support them. There are penalties for not keeping adequate records, for not giving the CRA access to your records when requested, and for not giving information to CRA officials when asked.

Income records:

Keep track of the gross income your business earns. Gross income is your total income before you deduct any expenses, including those related to the goods sold. Your income records must include the date, amount, and source of the income. Record the income whether you received cash, property, or services. Support all income entries with original documents. Original documents include:

- sales invoices

- cash register tapes

- receipts

- bank deposit slips

- fee statements

- contracts

Original documents for farming include sales invoices, cash register tapes, receipts, cash purchase tickets from the sale of grain, and cheque stubs from marketing boards. Original documents for fishing include sales slips for each landing, trip settlement sheets, and slips or records of sale to the public, retailers, and restaurants.

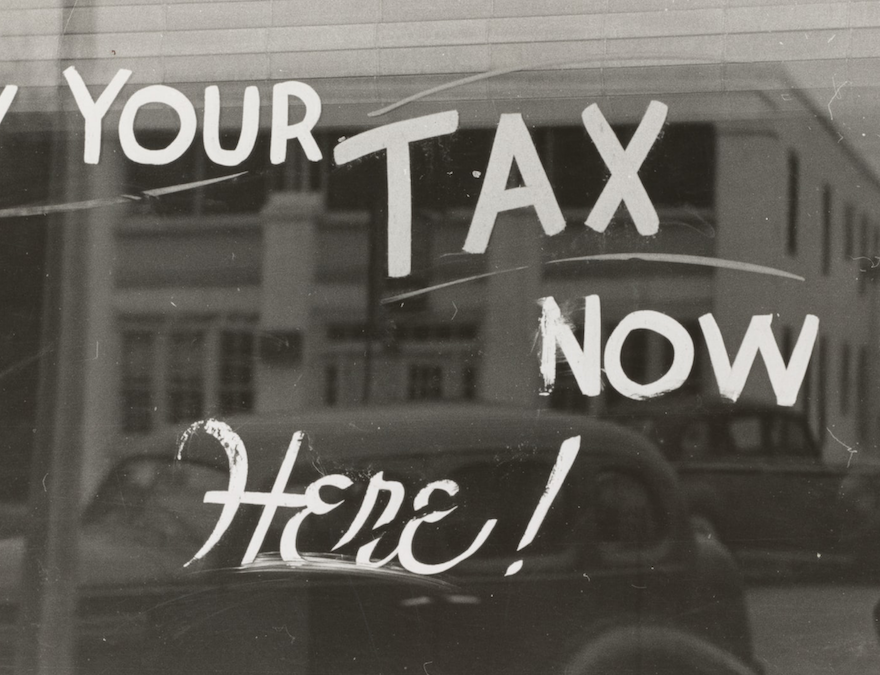

See the diagram example taken from P 12 of the Canada.ca/taxes site.

Send me a note via the Contact me tab and let’s get your business books in the order you deserve. I have room for two clients right now! I hope you’re one of them!